In case you don’t know, the City of the Village of Clarkston charges $200 to rent Depot Park. Or at least that’s the fee Clarkston charges to people and organizations who don’t have special connections to city government (unlike our city manager).

During the July 25, 2022, city council meeting, the city manager asked the council to approve a fee waiver for the Clarkston Community Historical Society (CCHS) for its annual Art in the Village event. Ironically, in that very same city council meeting, a taxpaying resident was told that she would have to pay the $200 fee to use a portion of the park for a movie event. The city made her jump through a bazillion hoops before giving permission, the event is free to anyone who is interested, and she’s paying for everything out of her own pocket – including the $200 park rental fee.

CCHS is an independent, tax-exempt, nonprofit 501(c)(3) entity. It has zero connection to the City of the Village of Clarkston, other than the fact that it has the word “Clarkston” in its name, it focuses on Clarkston history, but most importantly, the city manager just happens to be the CCHS president. (You can learn more about CCHS by going to its website: http://www.clarkstonhistorical.org.)

Art in the Village is not a city-sponsored event. It’s a huge annual fund-raiser for CCHS that involves taking over virtually every square inch of Depot Park. This year, the city manager doesn’t think CCHS should pay the $200 fee that the city would make you pay, even though he admitted that CCHS has paid this nominal fee every other year so it can have a place to hold its special event.

Here are some things the city manager told the council on July 25th (and you can find the unofficial transcript of that meeting, including a link to the video at the bottom so that you can hear what happened for yourself – https://www.clarkstonsunshine.com/july-25-2022-city-council-meeting/):

-

- Art in the Village is the main fund-raiser for CCHS

- The city manager is president of CCHS

- CCHS employs the city manager’s wife

- Art in the Village funds all CCHS museum operations and pays for second grade educational books

- There was no Art in the Village during COVID

- Last year’s Art in the Village was “very successful” and one of CCHS’ better years

- Art in the Village will be expanded even more this year, and so many vendors want to participate that the city manager thinks they will reach the 120 maximum vendor capacity

The city manager claimed that the city council always waives the $200 rental fees for nonprofits, and he apparently wanted to get a piece of that action for his own nonprofit. Councilmember Wylie pointed out what should have been glaringly obvious – that the $200 fees were previously waived for other nonprofits that likely didn’t have much money and weren’t running giant fundraisers in Depot Park.

But in the end, that didn’t matter to the city council. The August 8th city council packet contained a resolution for the $200 waiver, no doubt authored by the city manager. I’ve attached it here: Resolution to waive $200 fee for CCHS. With only Councilmember Avery absent, the city council unanimously approved the $200 waiver on August 8th (notwithstanding Wylie’s previous objection), and the city manager bragged about the approval in his weekly email.

The fourth paragraph of the resolution states: “As in year’s [sic] past, the Society will pay the DPW [Department of Public Works] wages for their time worked during the Art in the Village weekend . . . ” Since this was the first time I’ve ever heard this, I sent a Freedom of Information Act (FOIA) request for those specific records, as well as records of any expense that Clarkston taxpayers have paid for Art in the Village, and records showing that any of those expenses were reimbursed (and by whom). As it virtually always does, the city did not timely respond to the request by granting it, denying it, granting/denying it in part, or extending the time and giving a reason for the extension within five business days, which constitutes a denial of the request under FOIA. I’ve merely been advised that I’ll be provided with this information “in the allotted time,” whatever that means. I’ll update this post if the city ever actually provides any records.

While I waited for the city to get around to responding to my FOIA request, I took a look at the city’s Revenue and Expenditure Report for the period ending June 30th (the last day of our fiscal year): 07-20-2022 Revenue & Expenditure Report, page 4. (This page was taken from the July 25, 2022, city council packet that I’ve linked here: http://www.villageofclarkston.org/AgendaCenter/ViewFile/Agenda/_07252022-1075?packet=true.) Since this was part of the last Treasurer’s report for the year (and ten months after the 2021 Art in the Village), this report shows where we ended up financially. You’ll note that the report indicates that the city manager budgeted (and council approved) $200 for the Department of Public Works for Art in the Village, yet we spent $2,012.07, an amount that exceeded the budgeted amount by 1,006.04%.

At the February 8, 2022, city council meeting, Councilmember Wylie asked about the overage, and the city manager claimed that there were expenses for the Taste of Clarkston and Concerts in the Park that were charged to Art in the Village. The city manager said that he would work with the treasurer to make a journal entry to correct that. More than six months later, that hasn’t happened, so we still don’t know how many dollars the taxpayers gratuitously provided to support the city manager’s nonprofit (and his wife’s employer), if any at all.

It’s also not clear that CCHS reimbursed anything for DPW wages when reviewing the city’s reports. The resolution for the $200 fee waiver rather nebulously states that DPW wages will be paid as they have been in the past. Is it possible that CCHS is employing DPW workers directly? It’s not clear. And if CCHS actually reimbursed the city, did it include gross wages, net wages, or some other number? Perhaps I’ll find out the answers if the city gets around to responding to my FOIA request. But if taxpayers are involuntarily paying anything to support CCHS – which should not be happening because it’s not a government function – then it’s even more outrageous that the city manager asked the city council to waive the $200 park rental fee for his non-profit, something that would have offset costs.

Since the city manager thought CCHS needed a $200 fee waiver, and Clarkston didn’t respond as required to my FOIA, I decided to find out more about CCHS’ finances. After all, they must desperately need the money if they can’t afford the $200 in rent for the use of our taxpayer-owned Depot Park for their massive fund-raising event, right?

Guess what? Because CCHS is a 501(c)(3) organization (a tax-exempt non-profit organization), it files a variation of federal tax form 990. Its tax return is public, with the very top of the form noting that it is “Open to Public Inspection.” You can find these types of tax returns posted on various informational websites as well as on the Internal Revenue Service (IRS) website. Not all these types of returns are available online (because the IRS is behind in its posting due to COVID). You can also make a written request for missing copies from the IRS or from the organization itself.

I’ll be asking CCHS for its current tax filing, but three seconds of research pulled up CCHS’ Form 990-EZ for 2019 (filed in 2020). That’s pretty recent – and quite interesting – so let’s start there.

Though they seem dry and boring, you can learn a lot of fascinating things by looking at tax documents. I’ll cut and paste some of the more interesting things below, and I’ve linked to the form so you can see it in its entirety for yourself: 2019 CCHS Form 990-EZ. Note that our city manager signed the tax return on page 4 and indicated that he was the treasurer, though he’s also listed as the president in the key officer listing, discussed later.

In 2019, CCHS apparently had so many investments that it declared $27,132 in investment income.

We don’t know exactly what investments these were, but we can guestimate their value. If, for example, CCHS was earning a 10% return on its investments (a generous estimate given current economic conditions), its investment principal would have been $271,320. If the return was lower, then the principal would have been even higher.

CCHS reported a whopping $175,488 in net assets! (Guess that’s how they were able to earn that $27,132 in investment income, huh?) It’s unclear how they could have earned that much investment income on just the reported net assets, but I don’t profess to be a tax or investment expert.

CCHS’ 2019 total reported expenses were $30,907:

But more than half of those expenses were $16,356 in salaries costs:

CCHS’s total revenue for 2019 was $52,073.

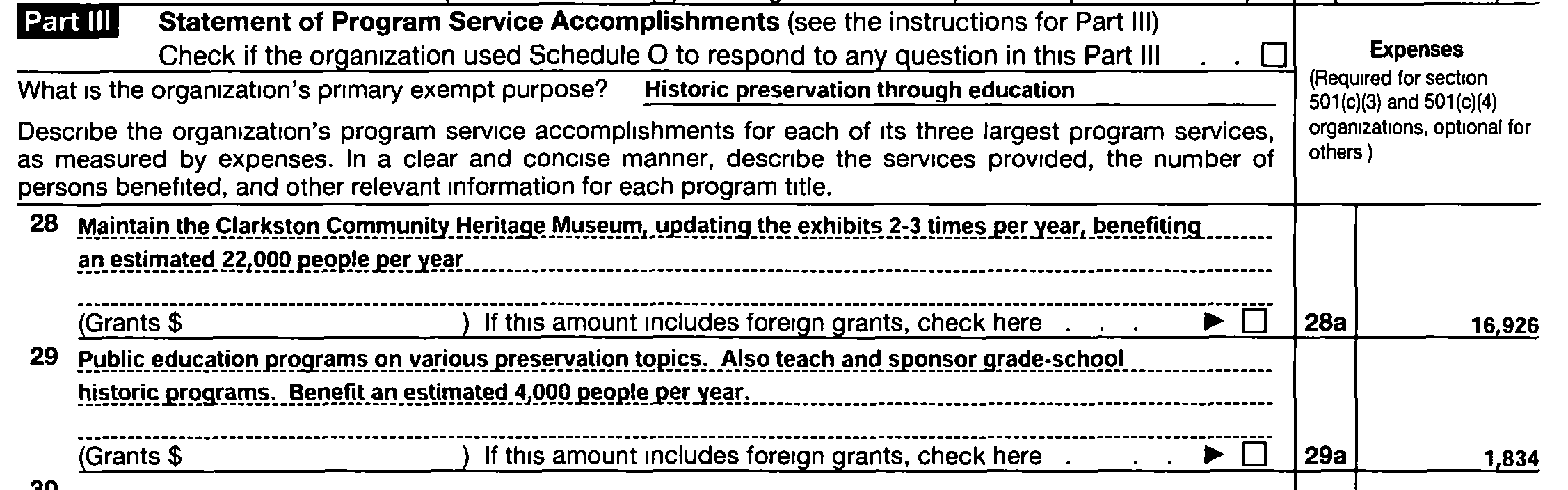

What exactly does CCHS do? Well, it tells us on the tax return. For the year 2019, it listed two “program service accomplishments.” It updates the museum exhibits (in the Clarkston Independence District Library) 2-3 times per year, which apparently costs $16,926, and it spent $1,834 on public education program expenses (perhaps this includes those second-grade educational books that the city manager mentioned?).

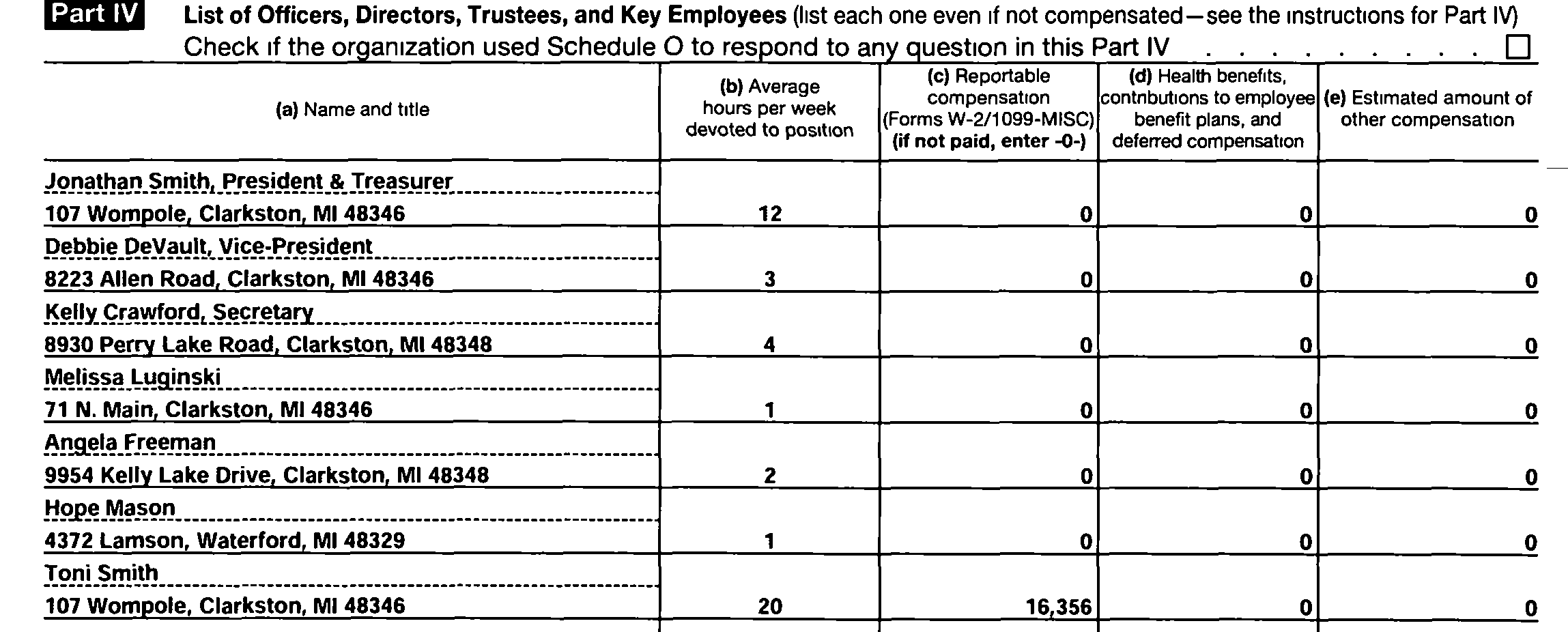

CCHS is required to list all its officers, directors, trustees, and key employees; how many hours they work; and whether they receive a salary or benefits.

Only one of the listed persons makes a salary of $16,356. Coincidentally, $16,356 is the same amount that CCHS reported on Line 12 where it was required to report salaries and benefits (that I cut and pasted above). Putting everything together, the only inference is that there is one person who gets paid by CCHS . . . and that is the city manager’s wife.

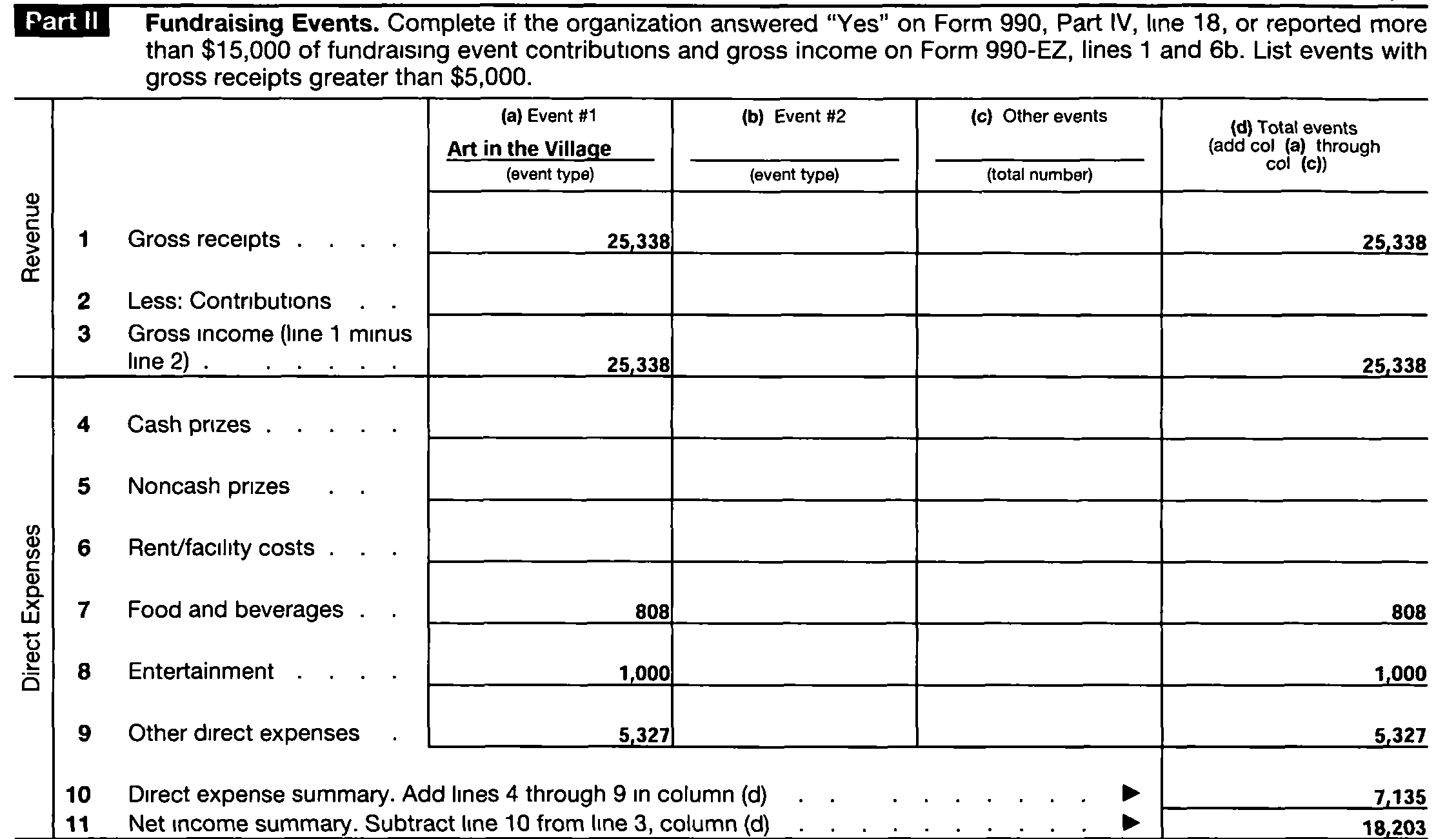

The only CCHS fundraising event in 2019 was Art in the Village, and it was required to report on this event on its tax return. Its net profit for the event was $18,203.

So, using our taxpayer-funded park enabled CCHS to earn enough net income in 2019 to pay the city manager’s wife’s salary and the cost of the educational materials. These two things totaled $18,190 ($16,356 for the city manager’s wife’s salary plus $1,834 for the educational materials). Though CCHS has other expenses (since they reported a total of $30,907 in expenses) they also have other revenue (which includes contributions, gifts, dues, and investment income, all of which are listed in Part I of the tax return). All in all, CCHS was very successful in 2019, and it was able to do all of this while paying the $200 park use fee and without jamming the maximum amount of vendors into Depot Park.

Since the city manager predicted that 120 vendors will attend this year, which presumably means that this year will be the most profitable year ever for CCHS, there is simply no reason to ask for – or for the city council to grant – a $200 park rental fee waiver so that CCHS can exclusively use Depot Park for two days. But, as we all know, our city manager gets whatever he wants, and taxpayers always come in second place.

I have no issue with CCHS. I think it’s a nice organization, I love local history, and I love the museum at the library. What I don’t love is the city manager using his position and influence to benefit a private organization (that he’s the president of), which just also happens to employ his wife – as its only employee. But that’s how Clarkston rolls. People with a certain last name, and people with connections to city government, always seem to get what they want.

Frankly, it stinks.

Interesting nepotism here. It’s shady and disgusting. You shouldn’t use your position in government to help your family in business.